It has now been almost two years since Russia illegally invaded Ukraine. What was expected by Russia to be an easy win has now become a war of attrition in an environment in which Western sanctions against Russia have continued to evolve in scope and complexity.

Last year saw a significant expansion of the types of sanctions imposed on Russia, with the UK, the EU and the USA all enhancing their respective regimes. From the implementation of, and subsequent circumvention tactics pertaining to, the oil price cap, to the addition of hundreds of oligarchs and their associated companies to sanctions lists, to new prohibitions on trust services, money market instruments and securities, new loans and new credit arrangements including investments in Russia, compliance has never been more complicated.

The sanctions regimes, despite Russian protestations to the contrary, also appear to be working, albeit slowly. However, with President Putin indicating that he is preparing for a protracted war, the landscape looks set to become ever more convoluted and compliance increasingly costly and challenging.

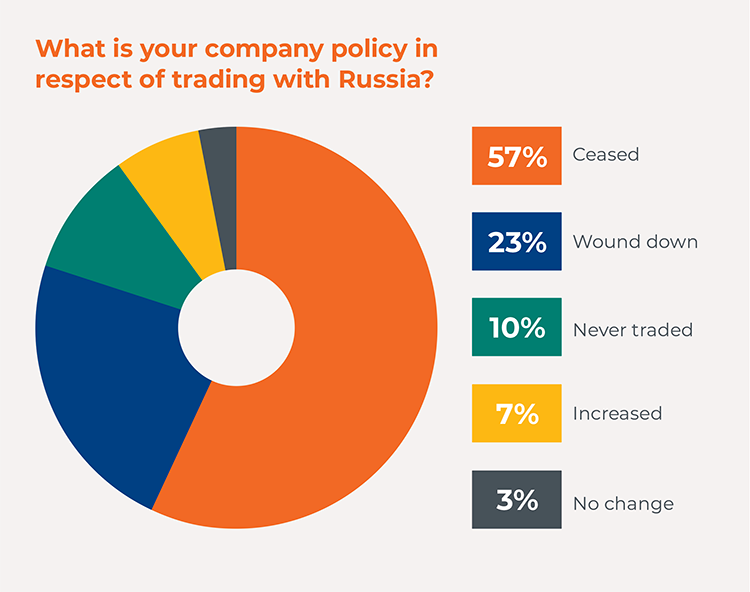

Despite almost two years of successive rounds of sanctions against Russia, our analysis has found that only 57% of respondents to a recent questionnaire indicated that they had completely ceased trading with Russia:

In this first article in a series addressing what the sanctions team at HFW consider to be the key trends for 2024, we set out below some issues which will likely be of interest to those engaged in business with any form of Russian nexus.

The Oil Price Cap

The oil price cap was implemented in the UK, the rest of the G7, Australia and the EU on 5 December 2022. We have previously published an alert on the details of the oil price cap which may be found here. In its annual review the Office of Financial Sanctions Implementation (OFSI) identifies that it will continue to enforce compliance with the oil price cap, and investigate suspected breaches, as well as influence coalition members and third country compliance and enforcement approaches.

It is that final aim which has become increasingly important. There are numerous indicators of Russia engaging in practices which are intended to circumvent the oil price cap.

On 20 December 2023, the G7 announced plans to “tighten” oil price cap rules. This has now been implemented in the EU and USA:

- EU – Regulation 833 now requires that, from 20 February 2024, (i) service providers that do not have access to the purchase price per barrel of Russian crude oil collect itemised price information for ancillary costs as provided by operators further up the supply chain of such Russian crude oil or petroleum product trade; and (ii) provide, upon request, that itemised price information to counterparties and competent authorities for the purpose of verifying compliance with the EU’s price caps. This is in addition to extant attestation and record keeping requirements.

- USA – The Office of Foreign Assets Control (OFAC) updated its Guidance on 20 December 2023 which “outlines new expectations for those service providers to 1) receive attestations within a specified timeframe for each lifting or loading of Russian oil or Russian petroleum products; and 2) retain, provide, or receive itemized ancillary cost information as required. To continue benefiting from the safe harbor detailed below, OFAC expects U.S. service providers to be in compliance with this updated guidance by February 19, 2024.”1

- UK – The UK has evinced an intention to follow suit, although at the date of publication of this briefing amending legislation has not been introduced.

The result of the updated rules is that there will be significant escalation in the compliance documentation required to trade in Russian crude and the importance in retaining that documentation in a readily accessible manner is clearly fundamental to demonstrating compliance.

Tanker Sales

Linked to the above, the EU’s 12th package of sanctions has also introduced notification rules for the sale of tankers, in particular second-hand vessels, to any third country in order to increase transparency of their employment. This is now of particular importance given understanding of the shadow fleet employed by Russia. It remains to be seen if the UK will follow suit.

Russian Diamonds

While Russia is the world’s largest producer of diamonds by volume, there has historically been limited appetite to sanction its diamond trade en masse. However, diamonds form a key tenet of the sanctions announced by the UK and the EU in December 2023.

On 1 January 2024, the G7, the USA and the EU banned imports of rough diamonds mined in Russia, and on 3 January 2024 the EU designated Alrosa PJSC and its CEO, Pavel Marinichev, adding both to the sanctions list. The ban exempts the import of Russian diamonds processed in third countries, but that exemption ceases on 1 September 2024. The USA placed Alrosa on its sanctions list on in early 2022.

From 1 March 2024, the G7, the USA and the EU will prohibit the import of diamonds that are processed in a third country outside of Russia and consist of diamonds originating in or exported from Russia with a weight equal to or above 1 carat per diamond. From 1 September 2024, the weight threshold will be lowered to 0.5 carats or 0.1 grams per diamond and a certification scheme to verify where diamonds were mined will be introduced.

These measures will have a significant impact on global diamond trade and will ultimately remove Russian diamonds from the G7, the USA and the EU, provided compliance is effectively policed by competent authorities. Much like with the oil and gas sanctions, there are numerous routes to circumvention and the value of these restrictions is significantly lower than their oil and gas counterparts. However, the symbolic nature of this new prohibition is not to be underestimated.

The “no Russia” clause

Regulation 833 imposes what is effectively a “no-Russia clause” which requires that, from 20 March 2024, EU exporters include contractual mechanisms to prohibit the re-export of specified restricted, particularly sensitive goods and technology goods to Russia when dealing with third-country business partners. Covered items include aviation goods, weapons and items used in Russian military systems or critical to the development, production, or use of those systems. The clause must contain breach provisions, which could include the right of withdrawal or termination, end-user statements and guarantees, and the right to information access; the concept is however undefined, and this vagueness may cause issues of itself. Exporters are required to report any breach to their competent authority immediately upon becoming aware.

US Secondary Sanctions

On 22 December 2023, Executive Order (E.O.) 14114 (amending E.O. 14024) was signed which imposes, among other things, secondary sanctions on non-US financial institutions which engage in activity involving Russia’s military-industrial base. The secondary sanctions may be imposed if the financial institution has:

- engaged in “significant transactions” pertaining to persons already targeted by US sanctions for operating or having operated in Russian technology, defence and related materiel, construction, aerospace or manufacturing sectors, as well as those who have conducted or facilitated such transactions; or

- conducted or facilitated a “significant transaction” or provided any service involving Russia’s military-industrial base, including the sale to Russia of certain specified items.

A “significant transaction” is defined vaguely and will be considered in light of “(a) the size, number, and frequency of the transaction(s); (b) the nature of the transaction(s); (c) the level of awareness of management and whether the transactions are part of a pattern of conduct; (d) the nexus of the transaction(s) to persons sanctioned pursuant to E.O. 14024, or to persons operating in Russia’s military-industrial base; (e) whether the transaction(s) involve deceptive practices; (f) the impact of the transaction(s) on U.S. national security objectives; and (g) such other relevant factors that OFAC deems relevant.”2

The new sanctions therefore represent a significant increase in exposure for non-US financial institutions who may now find themselves subject to US secondary sanctions for direct and indirect support of Russia. Examples of the type of activity which may breach E.O. 14114 (which amends E.O. 14024) include:

- Maintaining accounts, transferring funds, or providing other financial services (i.e. payment processing, trade finance, insurance) for any persons, either inside or outside Russia, that support Russia’s military-industrial base, including those that operate in the specified sectors of the Russian Federation economy.

- Facilitating the sale, supply, or transfer, directly or indirectly, of the specified items to Russian importers or companies shipping the items to Russia.

As a result of this renewed focus by the US, several Turkish and Chinese banks have indicated that they are terminating their relationships with Russian banks, for fear of US secondary sanctions. There also remains a question as to whether and when this E.O. will be expanded to include other parties, for example logistics providers, shipowners and other facilitators of international commerce.

Reporting

There are two new reporting dates, of which EU entities should be aware:

- 1 May 2024 – EU entities that are directly or indirectly owned more than 40% by a company established in Russia, a Russian national or a natural person residing in Russia will be required to notify their competent authority of any transfer of funds out of the EU exceeding EURO 100,000 (both as a single transaction and in tranches).

- 1 July 2024 – EU credit and financial institutions will be required to report to their national competent authority information on all transfers of funds out of the EU of an amount exceeding EURO 100,000 cumulatively that they initiated directly or indirectly for the above entities.

Enforcement

We will discuss enforcement trends in the next article in this series.

Impact on compliance

It is patently clear that compliance with this increasingly complex and nuanced set of sanctions has never been more important. The war looks set to continue for the foreseeable future, unless inflation and a consequent devaluation of the Rouble hamper Russia’s efforts, and sanctions are highly likely to continue for a considerable time once the war comes to an end, whatever that “end” may look like.

There are therefore some key steps that organisations should take now and, indeed, continue to review in the coming months and years:

- Audit sanctions and compliance programmes on an annual basis. Doing so identifies risk and allows for appropriate mitigation measures to be implemented. It is important that those implementing policies and procedure (i.e. the first line of defence) are involved in audit work as this ensures that they are operationally workable.

- Consider the interaction between compliance, sanctions and export controls teams, as there is a clear regulatory focus on enforcement in the export control space.

- Where appropriate, update internal systems and controls, which may include enhancing due diligence processes, upgrading reporting lines and documentation, enhancing senior level discussion about risks and mitigants, upgrading technology and implementing stricter controls.

- Audit long term contractual arrangements to minimise scope for inadvertent breaches and linked regulatory exposure.

- Consider best practice for contractual wording and update standard documents as required, including reviews of limitations of liability, warranty, force majeure, sanctions and material adverse change clause. Firms who export listed goods to any non-EU country (with certain exceptions) will need to incorporate a “No Russia Clause”.

- Update and re-configure IT systems to minimise both missed red flags and false flags. The UK, the EU and the USA appear to be ramping up additions of individuals and entities to sanctions lists and it continues to be important to consider how to ensure that designations by category are also caught.

- Be wary of the 40%/50% ownership requirements when engaging in transactions with a Russian nexus.

- Roll out and update training appropriate to the recipients. What is required for a screening team will be different to that which a board needs to know.

- Consider whether ongoing business operations in or linked to Russia remain commercially viable, particularly in circumstances in which the direction of travel is to include subsidiaries and other links to Russia within the various sanctions regimes.

- For companies which export to or import from Russia, updated listings of goods and identifiers will require a review existing controls and risk assessments.

- For non-US financial institutions which require access to US clearing banks, enhanced due diligence on any transactions with a potential Russian nexus is advisable.

- For those in the oil and gas sector, it may be prudent to undertake a full risk assessment to ensure compliance with the new requirements on complying with the oil price cap.

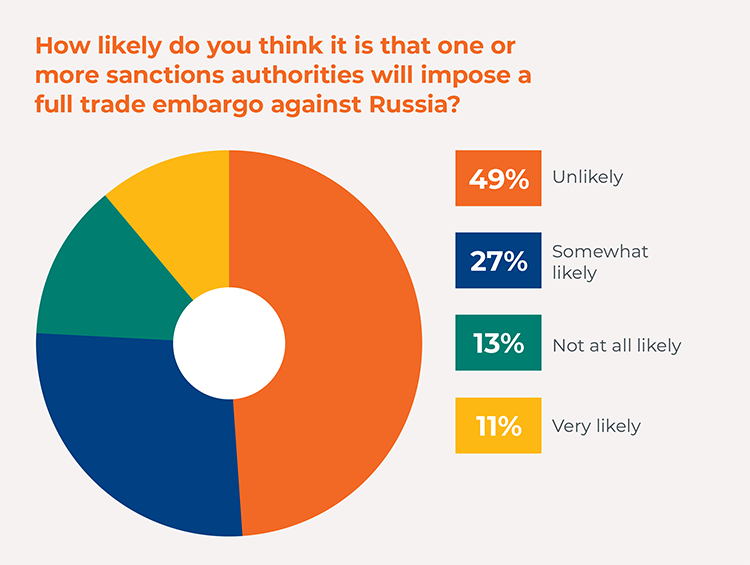

With sanctions compliance becoming ever more important, companies are advised to allocate time and resource to minimising the scope for breach. Indeed, responses to our survey above indicated a considerable level of uncertainty about what comes next:

The team at HFW are on hand to provide advice on all aspects of sanctions and export controls. If you are interested in finding out more about HFW’s work in this area, or require guidance with, please feel free to reach out to our team.

https://www.hfw.com/Whats-in-store-for-2024-Russian-Sanctions