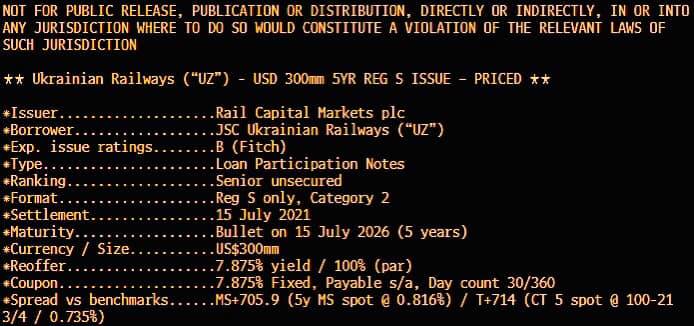

PJSC Ukrzaliznytsia (UZ – Ukrainian Railways) has placed Eurobonds for the amount of 300M USD to refinance the company’s old debts, as reported yesterday by Acting Chairman of Board Ivan Iuryk.

According to him, the bonds have been floated at the historically low for UZ rate 7.875% annual.

“These monies are entirely destined to refinance our old debts taken a decade ago at much higher rate, hence these funds won’t result in the financial burden enlarged, yet will decrease the average weighted rate of our credit portfolio”, Mr Iuryk commented upon.

As it was noted by JS UZ, the bonds emission is going to lower the company’s debt in a short-term period.

The demand for Eurobonds has already overshot twice the company’s offer, 70 investors applying for the purchase, mainly from the UK and Switzerland.

Let’s remind you that earlier Fitch Ratings assigned this UZ 5-year Eurobonds issue the anticipated rating B (EXP) and placed it to the Rating Watch list as Negative. This ‘Negative’ status mirrors the company’s marketability insufficiently available for use as of the end of April 2021. Upon the successful bonds floating the UZ ratings are probably subject to deletion from that Negative list of Rating Watch, as said the Fitch Ratings report.

https://cfts.org.ua/news/2021/07/09/ukrzaliznytsya_razmestila_evrobondy_na_300_mln_dollarov_65687